Making banking accessible for neurodivergent users

Spotted: According to the World Economic Forum, between 15 and 20 per cent of the global population is neurodiverse. This includes individuals with autism spectrum disorder, ADHD, and dyslexia.

For many neurodiverse individuals, it is easy to become overwhelmed when navigating public spaces and everyday activities. Now, Magnusmode is working to help neurodiverse people gain independence in daily living with step-by-step digital guides.

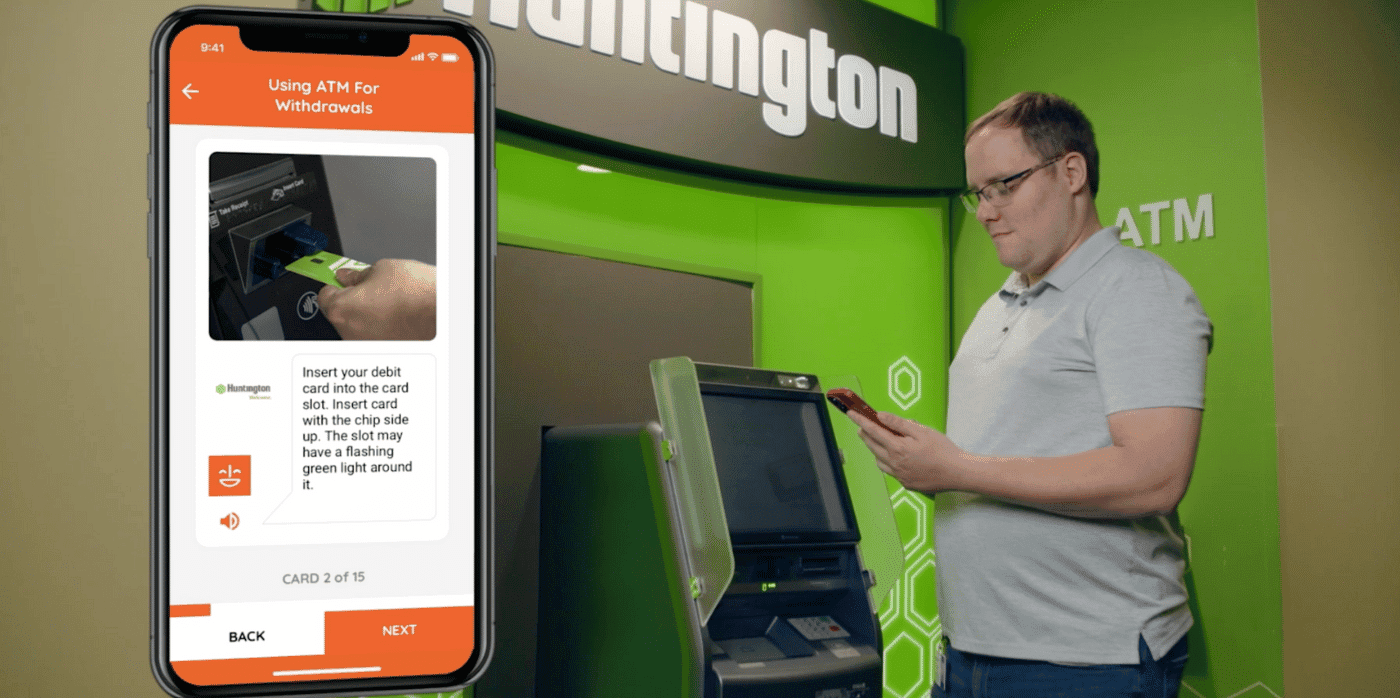

Magnusmode has developed a free mobile app called MagnusCards that provides digital ‘card decks’ for everyday activities in categories such as money, safety, shopping, and food. Each deck provides images, detailed step-by-step instructions, and positive, encouraging reinforcement for basic transactions. The collectible decks have been created in partnership with various businesses and non-profits and are designed to walk users through tasks such as ordering food in a restaurant and getting a library card.

In December 2022, Magnusmode teamed up with Huntington Bank to create a card deck specifically designed to help neurodiverse individuals become more financially independent. The Huntington Card Decks feature real-life scenarios such as paying with a debit card, using an ATM, and paying bills. The guides feature two Huntington Bank employees who are themselves neurodivergent.

Increasingly, innovators are looking at ways to boost accessibility across various industries. In the archive, Springwise has also spotted an education platform to help unbanked communities and a plugin that helps travel agencies serve disabled customers.

Written By: Lisa Magloff