Keeping your sensitive data safe if your phone is stolen

Spotted: Mobile phone theft has become so common, occurring approximately every six minutes in London, that phone companies and the city mayor met in late 2023 to explore collaborative means of reducing such robberies. And, with smartphone capabilities having grown rapidly in recent years, the problem goes beyond the loss of a handset; a stolen smartphone now opens up the potential for criminals to access important personal data, including bank accounts and crucial passwords.

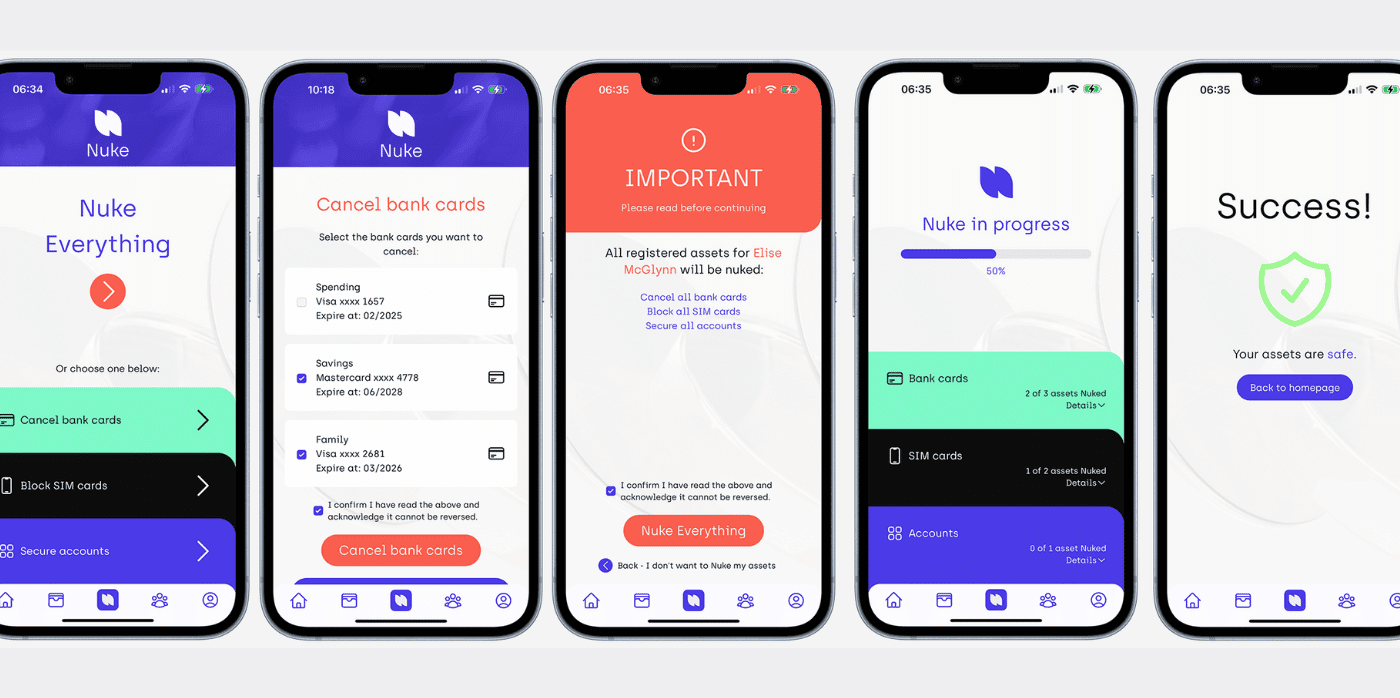

UK fintech startup Nuke From Orbit has created an app to help prevent the loss of such valuable data. The Nuke app allows users with an account to list other devices and a network of contacts as backups. Should the worst happen, and someone is locked out of their various accounts because their phone has been stolen, the user logs in via another device or listed contact to securely access their Nuke account.

Nuke From Orbit’s recent research found that 51 per cent of mobile owners use a digital wallet, which means that an unlocked phone poses great danger to the user if someone else is in possession of the handset. To alleviate that threat, Nuke From Orbit’s first-of-its-kind digital panic button allows account holders to block access to bank accounts, SIM numbers, web accounts, and more, as well as cancel bank cards. Users can then begin the onerous process of resetting passwords and ordering new bankcards but without the added stress of having lost money.

Nuke offers a free version of the app that provides protection for web accounts only. To protect bank accounts and payment cards, users must sign up for a monthly or yearly subscription. Nuke requires a minimal amount of personal data to set up an account, along with a relatively complex password, and there is no limit to the number of accounts that can be listed in the Nuke app.

As more of the world’s financial interactions move online and offline communities begin connecting to the internet, data security grows in importance. Innovations in Springwise’s library, like an offline banking platform and the use of blockchain in tracing supply chains, highlight some of the ways financial and digital transactions are being kept secure.

Written By: Keely Khoury